Are Gambling Winnings Taxable In Canada

If you play poker online, whether or not you have to pay tax on your winnings or can deduct your losses may depend on how often you play and what percentage of your total income comes from that gambling activity. The Canada Revenue Agency’s longstanding position on gambling profits is that “an individual may be subject to tax on income. The short answer is no. Your online winnings are not taxable in Canada, unless you are a professional gambler living from your earnings. Even that is a roller-coaster ride when you consider big wins as profits and large losses as expenses to offset those profits. Why Don’t Online Casino Players Pay Taxes On Their Winnings? No, if you win, regardless of the amount or which online casino play at, you don’t need to pay taxes from your winnings in Canada. Since gambling is not considered a viable source of income, the Canadian government doesn’t see it fair to tax it. Oct 20, 2019 By completing a tax return in the United States, a Canadian winner will recover some or all of the taxes paid. Note that this is happening this way specifically because Canada does not tax gambling winnings. Most other countries that also tax gambling gains have agreements with the United States to avoid double taxation. Gambling Winnings Tax in Canada There is no gambling winnings tax in Canada if you are a recreational gambler. The Canadian Revenue Agency generally keeps its hands off any money earned through gambling. We use the term “generally” because there are exceptions to the rule.

Taxation of Gambling Winnings in Canada

Time for a blog post about taxes. How are gambling winnings in Canada generally taxed? What if you play in a poker tournament in Canada? Are those winnings taxable? Does it matter if you’re a professional poker player or not?

In each case it will depend on a factual determination of whether you are carrying on the business of being a poker player or a gambler.

Source Income

Very generally, the “income” in respect of which one is taxed in Canada is one’s “income from source” as set out in the Income Tax Act[1] (the Canadian equivalent of the Internal Revenue Code). What is income from source? It is a productive source of revenue from an office, an employment, a property, a business, or (without limiting the generality of the foregoing) an “other source.” Income from betting or wagering isn’t from an office or employment, and it’s not conceptually like the rents, interest, royalties, or dividends that come from property. The courts in Canada have demonstrated a reluctance to extend tax liabilities to cover unenumerated sources (the “other source” referred to above) of income; it’s unlikely that any gambling activities would be included in unenumerated sources.

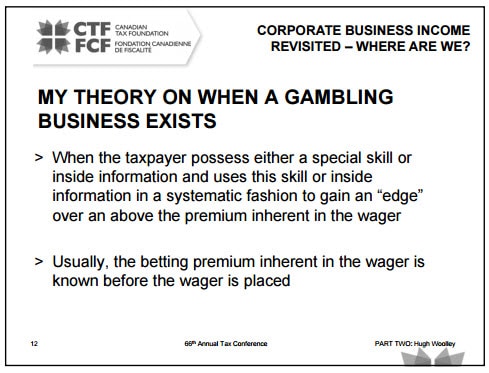

That leaves income from business. When one carries on business in Canada, whether as a resident or a non-resident, one is generally taxable on the profit associated with that business. So, can a gambler be carrying on the business of gambling? The answer is that it’s conceptually possible, but it’s not easy.

In order to carry on business as a gambler based on the decided cases, one has to carry on a business with a fairly high level of skill. The two most prominent cases where a person was found to be taxable on gambling winnings involved a professional golfer who made money wagering on his own performance in matches[2] and a snooker player who hustled drunks in money games.[3]

There is an old paragraph of the Act called “right to a prize” that provides as follows: “a taxpayer’s gain or loss from the disposition of (i) a chance to win a prize or bet, or (ii) a right to receive an amount as a prize or as winnings on a bet, in connection with a lottery scheme or a pool system of betting referred to in section 205 of the Criminal Code, is nil.”[4] While this language appears straightforward, this paragraph is of limited assistance and raises more questions than it answers; section 205 of the Criminal Code was repealed in 1985.

Lotteries, Games of Chance & Sports Betting

It’s safe to say that a person in Canada winning a lottery prize or winning at a game of pure chance (e.g., craps, roulette, or slots) is not subject to Canadian income tax on those receipts and, in fact, no modern reported case that I am aware of has found such receipts to be taxable. This makes intuitive sense as it would be difficult to imagine anyone actually making a commercial living based on pure chance.[5]

What about sports betting? In perhaps the leading case on the taxation of gambling winnings in Canada right now,[6] these kinds of winnings were not held to be taxable. The taxpayers in that case played the provincial sports lotteries. Even though they were financially successful, devoted themselves to the activity full-time, and had an organized and systematic approach to playing the lotteries and comparing posted odds to the Vegas odds, the court concluded that they were compulsive gamblers “continually trying their luck at a game of chance.”

The Poker Situation

Poker, however, provides an interesting possible counterpoint. Again, for most people, and certainly for the casual player, there will be a presumption against taxation of poker winnings as they will not be from a business. But what of the professional[7] poker player? Although there is no remotely recent case holding that a professional player is taxable on her profits from poker, it’s possible to see how such a case could be made by the government. Among other indicia, if a resident in Canada is successful in poker with solid and consistent profits from the activity over a number of taxation years, has no material income-earning occupation other than playing poker (or related to playing poker – sponsorships, for example), and is a student of the game and works at learning and improving her game, then it seems likely that that resident would be classified as carrying on the business of being a professional poker player and be taxable on her profits from the game.

Making an actual determination like this would be extremely difficult. Where is the tipping point at which a taxpayer makes the leap from an amateur player to a professional sufficiently devoted to poker, consistently winning, and making good money? These things are much easier to nail down in theory than in practice. This is part of the reason that the Canada Revenue Agency is reluctant to assess people as having income from carrying on the business of playing poker; if business profits are taxable, then business losses can be also used to reduce income from that business and (in the case of individuals) from other businesses or from employment. If the government gets overly aggressive with taxing poker players, it could eventually find that it results in a net drain on Canada’s tax revenues.

How could the tax laws in Canada apply in a land-based poker tournament being held in Canada pursuant to applicable provincial laws and regulations? This is an interesting question. An amateur player would likely not be taxable, but let’s assume that a professional poker player who is resident in Canada wins such a tournament. Again, based on an analysis that the player has the hallmarks of a professional poker player discussed above, those winnings would likely be included in the player’s income from a business.

What of a United States resident professional player winning such a tournament? Non-residents are generally taxable on income earned from carrying on a business in Canada, and “carrying on business” in this context is broadly defined.[8] However, the Canada-US Income Tax Convention (the “Treaty”) provides that where a US resident is carrying on business in Canada, the business profits are taxable by Canada only if the US resident is carrying on business through a permanent establishment. Permanent establishment in the Convention is an inclusive definition, which means the examples given are not exhaustive – things can be permanent establishments even though they’re not specifically itemized. However, this enumerated list includes structures and relationships like a branch, an office, a factory, a construction site, and an agent in Canada habitually exercising authority to conclude contracts in the name of her principal. It’s highly unlikely that a non-resident coming to Canada and playing in one land-based tournament and then leaving the country would be seen to have a permanent establishment in Canada.

Therefore, it doesn’t appear that a US professional playing at a Canadian land-based tournament would be subject to tax in Canada under the terms of the Treaty, which also suggests that the tournament would not withhold on any payments to that non-resident. Indeed, there appears to be no withholding obligation for such a payment to a non-resident in the Act. (In each case of a non-resident, it will be important to know what her home country’s tax convention with Canada says, if in fact the two countries have signed one.)

Income Derived From an Illegal Source

One other comment should be made: If one has income from an illegal activity, in Canada that income is still generally taxable even though ill-gotten.[9] Accordingly, players and gaming operators (including poker operators and players) committing offences under the Criminal Code, whether in bricks-and-mortar facilities or online, may still very well be taxable on their activities. Given that criminals often hide their incomes, this note is more technical and of less practical use to most people.

[1] R.S.C. 1985, c. 1 (the “Act”). There is an excellent and recent article addressing the income tax aspects of poker in Canada: Income Taxation of Poker Winnings in Canada by Benjamin Alarie. Alarie addresses many of the issues in much more detail than I do here. However, I will also talk about non-residents participating in land-based poker tournaments, which Alarie did not discuss.

[2]Dowling v. R., [1996] 2 T.C.J. No 301 (T.C.C.).

[4] Paragraph 40(2)(f).

[5] This ignores any possible ‘breaking’ of the provincial lotteries or some other way of systematically reducing or eliminating the odds of losing. See the interesting article in Wired by Jonah Lehrer for some perspective on this. This could, at least conceptually, make a “random” game, if pursued systematically and consistently, a business or adventure or concern in the nature of trade for tax purposes.

[7] By this I don’t mean a professional in the sense that one is regulated by a governing body to which one pays dues, has professional insurance, etc. I use the term more loosely to describe any individual that receives income that is compensation for or attributable to the individual’s activities as a player in a sport or activity.

[9] See for example R. v. Poynton (1972), D.T.C. 6329 (Ont. C.A.).

So, you reached the best part of sports betting – the payout. You have requested your winnings from your Canadian betting site and the money is now in your bank account – some genuinely exciting stuff.

Now though you may be wondering whether you are due to pay taxes on your gambling winning and if you have to, how you go about paying taxes on the money you won betting on sports online. If that is the information you are looking for, then this page is for you. We cover just about everything related to taxes and gambling winnings.

Do I Pay Tax on Online Gambling Winnings in Canada?

The general rule on legal gambling winnings and taxes in Canada is simple. Unless you are a professional gambler, you do not need to pay taxes on your gambling winnings. This rule is applied to both gambling winnings won in Canada (such as playing a provincial sports betting service or the lottery) and gambling winnings won outside of Canada (either using an online betting site or when you visit physical casinos in other countries).

But, why, unlike the United States which taxes winnings over $1200 at 30% does Canada not tax their gamblers? It is a pretty simple answer. The Government of Canada and Canada Revenue Agency do not consider gambling to be a constant and viable source of income (there is one exception to the rule which we will touch in a moment). Gambling losses are not deductible on your income tax if you only gamble for fun.

The laws around gambling taxes were also developed for offline betting inside Canada. Betting in Canada is regulated and taxed already. The Canadian Government may one day develop new laws taxing gambling winnings won online or outside of Canada. However, they seem more focused on making their sports betting more competitive and comparable to online sports betting sites, than taxing online sports bettors.

When You Pay Taxes on Gambling Winnings?

As we mentioned above, there are a few scenarios where you do need to pay tax on gambling winnings.

If you are a professional gambler; defined as an individual who makes the majority of their income through a form of gamble that is not the lottery, then you are required to declare winnings (and losses) on your tax return.

You are also subject to tax on gambling winnings if you invest your winnings and earn interest or some form of capital gains. The interest is considered a source of viable income and you will need to claim it on your tax return. Of course, with low-interest rates continuing in Canada, the interest earned by most is likely not enough to impact most sports bettors or push many into a higher income tax bracket.

There is no tax rate on gambling winnings in Canada. The amount of tax, if applicable, on gambling winnings in Canada depends on your total income from gambling plus your total income earned through other sources minus your total losses from gambling.

If you have any doubts or believe your income from gambling is noticeably high – especially if it is higher than the rest of your income – you could consult a tax account or tax lawyer. They can provide more details on taxes and gambling winnings in Canada.

What can you Bet Online?

Online betting sites offer plenty of different forms of gambling for Canadians to enjoy. While this website is more focused on sports betting and what online sportsbooks offer in terms of sports betting options, the sites we recommend on this page offers much more than just odds on stuff like the National Football League.

- BetwayBet NowNew Canada customers only. Opt-in required. Bonus based on 1st deposit of $10+. You will get a 100% matched bonus up to $200 based on your first deposit. Full terms apply.

- Bet365Bet NowOpen an account with bet365 today and bet on a huge range of markets with the world’s favourite online sports betting company.

- Sports InteractionBet NowNew customers only. Min $20 deposit. Max $200 CAD bonus. Rollover is 10x deposit + bonus.

- BodogBet NowThis bonus can only be redeemed on your FIRST DEPOSIT. Rollover is 5X Sports 5X Horses 40X Casino.

- Spin Palace SportsBet Now1st Deposit - Free Bet up to $200 • New customers only • Min deposit $10 • 5x wagering at odds of 1.3+ to unlock free bet • Terms apply

Online Casinos and Poker

A big part of online betting sites is their casino. Canadian online betting sites offer full virtual casino experiences. Canada online casinos feature different styles and domination of virtual slots. They offer a full selection of table games such as roulette, blackjack, baccarat, and craps. They also offer poker rooms. Like when you bet on sports online, when you play casino games and poker you do not need to pay taxes on your winnings unless it is your primary source of income (a general rarity in Canada except for a few poker players).

Online Racebooks

Another big part of an online betting site is their racebook. Any good online betting site will offer odds on horse racing events from all over Canada and the world. Like sports and casino winnings, bettors in Canada are not required to pay taxes on the money they win betting on the horses.

Betting on eSports

The last part of an online betting site is its eSports betting section. As eSports have grown substantially in popularity over the last few years, any online betting site worth using has an extensive number of betting markets on eSports. Winnings from betting on eSports, like traditional sports betting, is not subject to taxes unless it is your main source of income.

Best Canadian Betting Sites

If you are ready to jump into the action and start betting on sports online, you are in luck. We have the best Canadian betting sites listed below. Join today to receive an awesome welcome bonus. If you are not sure which site to join, you can read our comprehensive online sportsbook reviews here.

Gambling Tax FAQs

Q: Do you have to Pay Tax on Gambling Winnings in Canada?

No, Canadians who gamble for fun are not required to pay tax on gambling winnings as the government does not view it as a consistent or viable source of income.

Q: What is the Tax Rate on Gambling Winnings?

Are Gambling Winnings Taxable In Canada

There is no set tax rate on gambling winnings in Canada. The tax rate for professional gamblers or for bettors gaining interest off their gambling winnings is determined by multiple factors such as total income, total losses, and total taxes paid over the year (i.e. you have a secondary income you paid taxes from).

Q: Do Professional Gamblers Pay Taxes in Canada?

Professional gamblers are subject to taxes if gambling is their primary source of income. Most professional bettors are poker players, not sports bettors, and are treated as freelance workers, meaning they can claim their gambling losses.

Q: How do you Pay Taxes on Gambling Winnings?

If you are required to pay taxes on your gambling winnings, you have two options. You can remit taxes throughout the year – most likely every three months at a percentage you decide – or when you file your tax return.

Q: Do Canadians Pay Taxes on when Gambling in the United States?

Are Gambling Winnings Taxed In Canada

Yes, if you win more than $1200 in the United States you are subject to a 30% tax. However, due to the Article XXII in the Canada US Tax Treaty, Canadians can file a US income tax form 1040NR and claim your gambling losses, to potentially receive back part of the taxes you paid on your winning. You can also do this as a dual citizen.

Are My Prize Or Lottery Winnings Taxed In Canada?

Q: Do Foreigners Pay Taxes on Gambling Winning?

If you are visiting Canada and either betting on sports, buying lottery tickets, or playing at a casino, you do not need to pay taxes on your gambling winning. However, if you are not in Canada when you win the bet, collecting the winning could be challenging – especially if it is a significant amount from the lottery.

Are Online Gambling Winnings Taxable In Canada

Q: How do you Make Money from Gambling?

The answer to this question is simple – you win more money than you wager. While many people will make money gambling in their lives, it is rarely anyone’s main source of income. Additionally, it is never recommended you treat gambling as a viable and reliable source of income. Gambling should be treated as a form of entertainment. If you have difficulty controlling your gambling, contact the customer service department at your online betting site to help you set limits and control your gambling.